High Efficiency PV Modules: Get What You Pay For

By George Touloupas

This article was originally published in pv magazine.

CEA has calculated the price premium that solar developers will swallow in return for the levelized cost of energy (LCOE) savings offered by the latest generation of high efficiency PV panels.

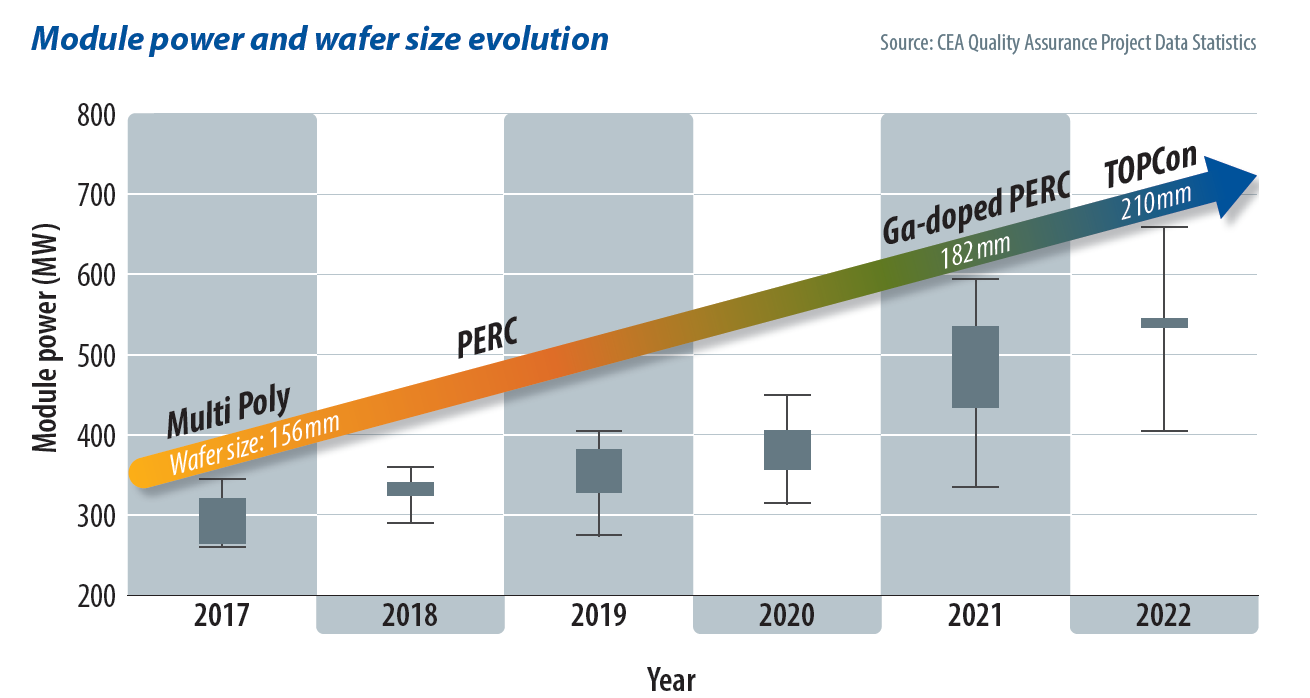

Developments in PV module technology have accelerated since 2018. The chart below – based on CEA quality assurance data – shows the most common modules for utility-scale projects in 2017, varied by technology, had a glass-backsheet structure and featured 72 six-inch cells – a module type launched in 2008.

Since 2018, we have witnessed the transition from multi-crystalline, aluminum back surface field (Al BSF) cells to mono PERC (passivated-emitter, rear contact) devices, the adoption of half-cut cells, the dominance of bifacial, glass-glass products, the introduction of multi busbar, a shift to larger wafers – 166 mm, then 182 mm, then 210 mm, the emergence of gallium doped p-type wafers, and, most recently, the rise of n-type cells, predominantly n-TOPCon (n-type, tunnel-oxide, passivated contact) products.

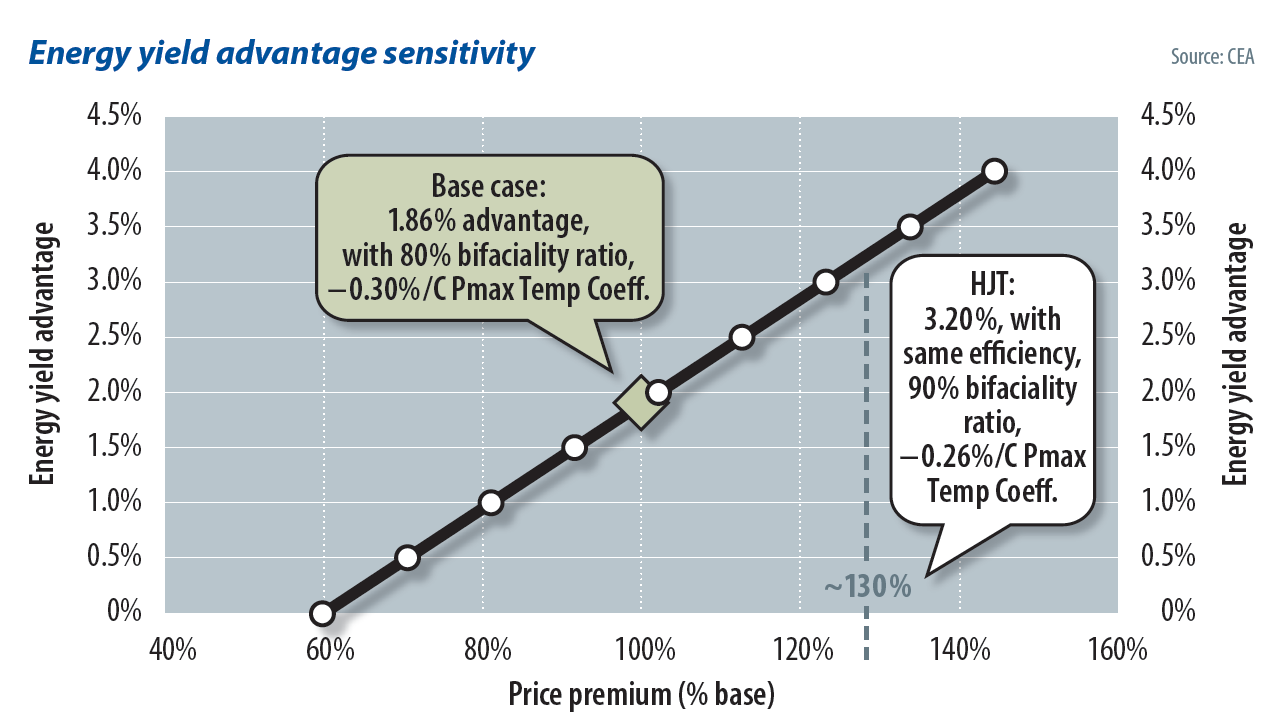

Figure 1: Energy yield advantage sensitivity

Wafer sizes grew to reduce costs. Market share today is split between 210 mm and 182 mm wafers as the advantages of each depends on project specifics. As production lines can be altered to produce either size, market share is fluid.

While “exotic” formats such as 218 mm wafers are unlikely to prosper, 182 mm variants have emerged, such as 182 mm wide by 185 mm products designed to minimize white space between cells in the long direction of the module. Trina Solar recently launched a 182 mm wide by 210 mm tall wafer. Ultimately, such variants are dependent on M10 or G12 solar ingot platforms and supply chains.

Figure 2: Module power and wafer size evolution

N-type moves

N-type solutions made an impressive entry in 2022 with several gigawatts of TOPCon generation capacity shipped already. TOPCon and heterojunction (HJT) cells are the main high-efficiency contenders to replace mainstream, p-type PERC cells. TOPCon and HJT cell architecture can be applied on p-type or n-type wafers but years of research have convinced manufacturers only n-type TOPCon and HJT variants can achieve an optimum efficiency-cost relationship.

TOPCon leads the race for now as legacy PERC cell production lines can be upgraded to produce it, whereas HJT requires retooling. TOPCon is also cheaper, thanks mainly to lower capital and operating expenditures.

Rival high-efficiency technology interdigitated back contact (IBC) solar has been touted as the “end-of-the-road” singlejunction silicon PV technology because going beyond 26% conversion efficiency requires tandem cells. IBC cells have their contacts on the rear side, theoretically offering the highest efficiency for singlejunction devices. However, front-contact TOPCon and HJT cells can become backcontact devices and several manufacturers appear to have planned such development. Longi, however, has chosen a p-type IBC architecture that probably uses PERC and TOPCon passivation.

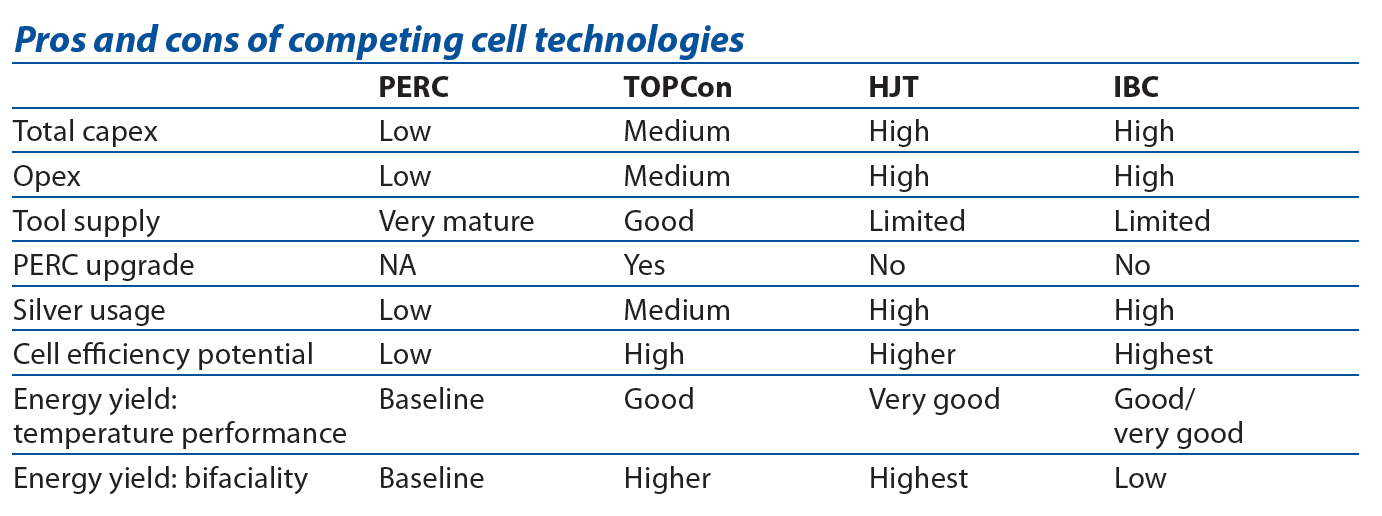

The pros and cons of competing cell technologies are summarized in the table (right), in which IBC refers to any passivation method, although properties such as bifaciality and tooling capital expenditure (capex) are linked to back-contact cells. An intense effort is underway to reduce the silver content of HJT devices.

Levelized energy cost

The pace of n-type expansion will rapidly accelerate once technology and cost hurdles are surpassed. Module buyers will accept a price premium on n-type if high efficiency and improved energy yield reduce capex and the LCOE. To measure such savings, CEA studied a 100 MW system on single-axis horizontal trackers in Spain. PERC and TOPCon cells were compared. Balance-of-system component costs were assumed from several sources, module cost and price data points were taken from CEA’s “PV Price Forecasting Report” and price tracking. PVsyst was used to measure energy yield.

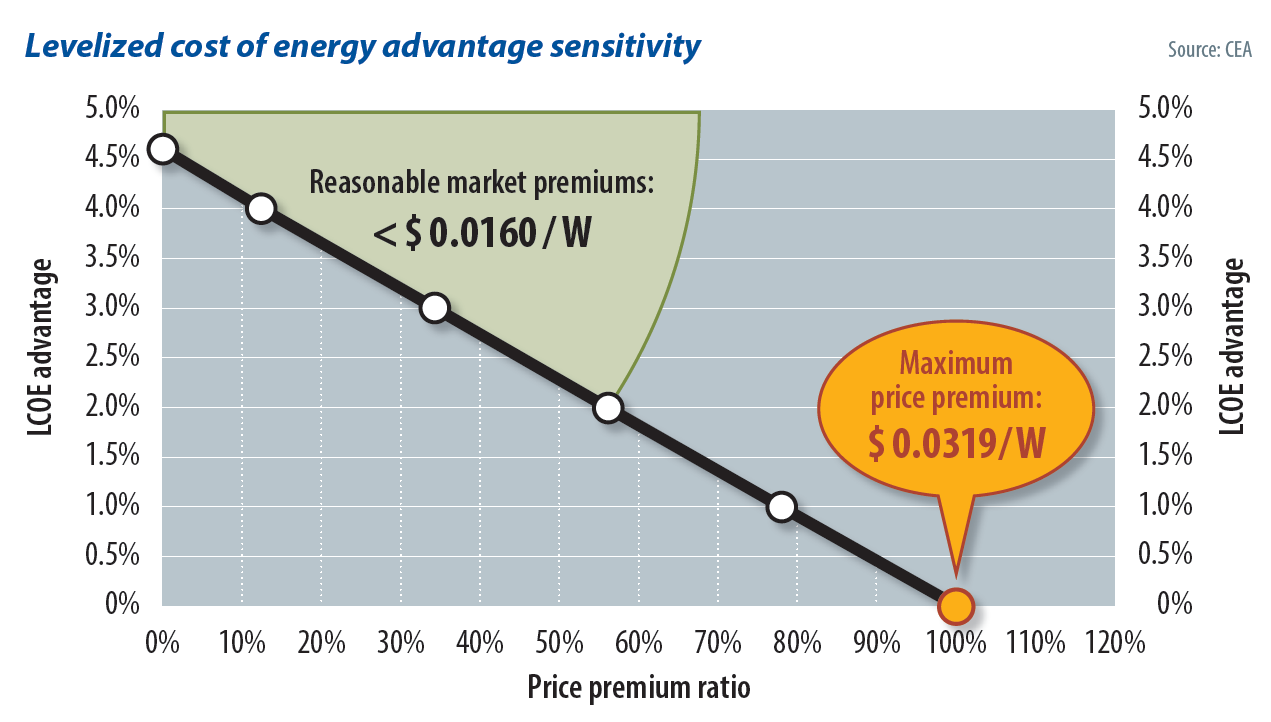

For the analysis, CEA defined a “maximum price premium” metric to indicate the amount a high efficiency module could command over a PERC panel without surrendering LCOE advantage.

CEA equalized the LCOE for PERC and TOPCon systems, deriving the TOPCon module price by adding the maximum premium to the PERC module baseline. Calculations showed TOPCon manufacturers can charge a premium of up to $0.0327/W over PERC without LCOE suffering. While buyers would not pay the maximum premium for zero LCOE advantage, they would pay extra for some LCOE gain. The chart (below) shows the sensitivity of the LCOE advantage to the price premium, with premiums below 50% of the maximum figure resulting in LCOE advantages of 2.5% or higher. In this scenario, a premium of less than $0.016/W would be reasonable.

Figure 3: Levelized cost of energy advantage sensitivity

The price premium for HJT modules – similarly efficient to TOPCon but with higher energy yield – could be roughly 30% higher than for TOPCon: around $0.005/W. HJT manufacturers must work hard to reduce their cost delta with TOPCon and aim for an efficiency lead. Modules are lowering the LCOE but pushing past tipping points accelerates the rate of change, making it difficult to estimate development timelines. As a web of factors influence LCOE, manufacturer claims need verification.

Table 1: Pros and cons of competing cell technologies