Five Strategies for Battery Procurement

By Cormac O’Laire

This article was originally published in pv magazine – October 2022 edition.

The worst effects of the pandemic may have passed, but supply chain disruptions continue to be felt across the world. The effects of the war in Ukraine are also evident to all of us in our daily lives, from commodities to energy, food supply chains and beyond. The disruption in the battery energy storage system (BESS) supply chain is no different. Indeed, as the cost of raw materials such as lithium climb, battery prices are being driven materially higher, on some accounts by 20% to 30%, rendering some projects uneconomical.

Battery energy storage system (BESS) transportation costs have been accelerating, with the price to transport a container from China to the West Coast of the United States costing an estimated 12 times as much as it did two years ago, while the time taken for the container to make that journey has nearly doubled.

These factors have helped to create a perfect storm. But there are actions that can be taken to mitigate the worst effects. For companies embarking on a large-scale BESS projects over the next few years, there are several strategies that might help overcome the challenges involved:

Diverse suppliers

The pandemic served as a wake-up call for many corporations around the world to improve the resilience of their supply chains, including by building more diversified portfolios of suppliers across all tiers. Never has this been more important. While some tier 1 suppliers may be sold out for the next few years, if your purchasing volume is less than 1 Gwh, you could consider a smaller tier 2 suppliers. Whereas larger buyers can leverage their scale to secure batteries from tier 1 suppliers, mid-sized or smaller players need to find the right-sized supplier. Many tier 2 suppliers have high-quality products, but buyers should protect their investment with strong contract terms and an end-to end, independent quality assurance program.

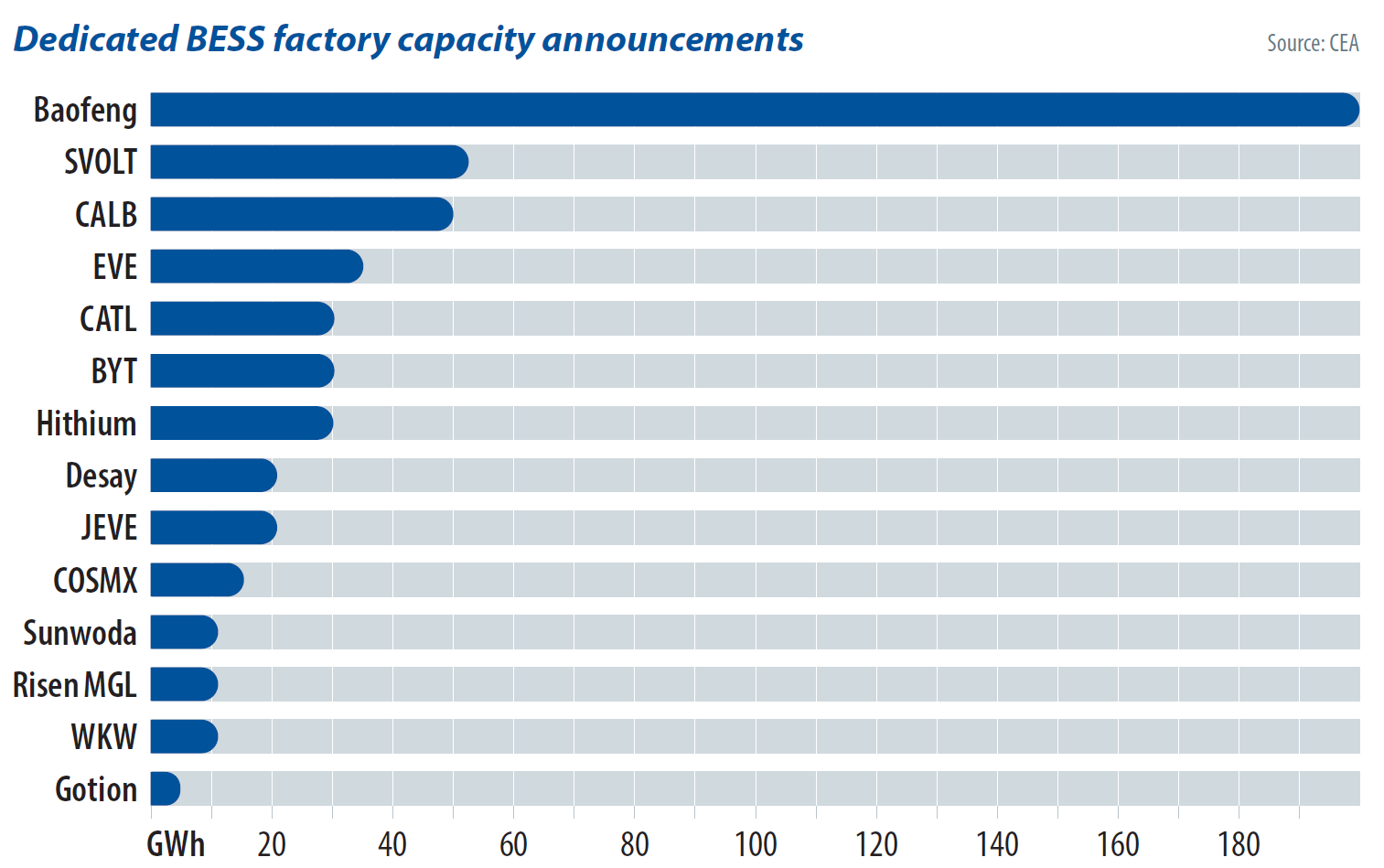

BESS - only factories

Many factories produce batteries for both electric vehicles (EVs) and stationary energy storage systems, and this can create challenges. The EV industry purchases ten times more battery capacity than BESS buyers, and EV buyers often offer long-term contracts with guaranteed volumes. As battery manufactures struggle with lithium shortages in the face of rapidly growing demand, EV industry buyers therefore tend to find themselves in an advantageous position in terms of the allocation of scarce capacity. Most small to mid-sized BESS buyers are less able to compete.

What is the answer? There are growing number of factories, including a combination of tier 1 and tier 2 suppliers, that solely manufacture BESS, eliminating direct competition with the EV industry. Consider sourcing from these facilities. Many of these factories aren’t yet built but will be up and running in the next 19 months, so now is the time to secure supply agreements. As raw materials costs increase, sourcing from local suppliers and fixing costs early is essential.

Non-lithium options

Although it is difficult to predict the future in such a dynamic and fast-changing environment, near-future contracts might reserve scarce lithium supplies for mobile applications, pushing stationary applications to migrate to other chemistries as EV demand accelerates. During this short-term supply crunch while the EV sector is consuming much of that lithium, there are other alternatives such as zinc and iron-based chemistries to consider. BESS buyers who do their diligence on these newer chemistries now will be in a much better position than those who wait.

Supply chain integration

If you are considering a tier 2 manufacturer, it can be reassuring to see multi-level upstream supply chain integration, including module, cell, and raw material supply.

Although you won’t face the EV sector competition as much if you go to a BESS-only factory, supply chain integration should help ensure access to raw materials.

Safety first

Safety incidents in the industry have been all too common. When considering a new supplier, buyers should carefully check the company’s safety credentials and industry certifications, as well as the possible failure modes with the battery type they supply, and how these are mitigated.

BES systems have orders of magnitude more stored energy than an individual EV, making the potential scale of a fire significantly different. it will provide some reassurance to know that tier 2 battery suppliers use the same technology and follow the same best practices as the tier 1 suppliers. Stringent thermal safety tests, however, are essential.

These are some strategies you can use to overcome battery system supply chain challenges and than can help alleviate the frustration of not being able to find calls available on short notice. Learning more about the options and incorporating the insights into your implementation plan as it evolves from year to year can help you avoid further disruptions along the way.

In July 2022, Stockholm-based Northvolt announce that it had raised $1.1 billion to finance the expansion of its battery cell and cathode materials production footprint in Europe. Northvolt’s third gigafactory, Northvolt Drei, In Heide, Germany, is expected to have a capacity of up to 60Gwh. It will start to produce its first batteries in late 2025.

Cormac O’Laoire is Senior Manager, Market Intelligence at CEA.