PV Solar Landscape and Polysilicon Outlook for 2021 and 2022

PV Solar and Polysilicon Production Outlook

This video covers the 2021 available polysilicon production capacity for solar vs the forecasted installations with Joseph Johnson, Manager of Market Intelligence at CEA. Be sure to check out the entire webinar on PV Solar Demand.

Video Transcript

And with that introduction, we will get into the main content of today's webinar, which is looking at the solar landscape into 2021 and beyond into 2022 and 2023 in some regards.

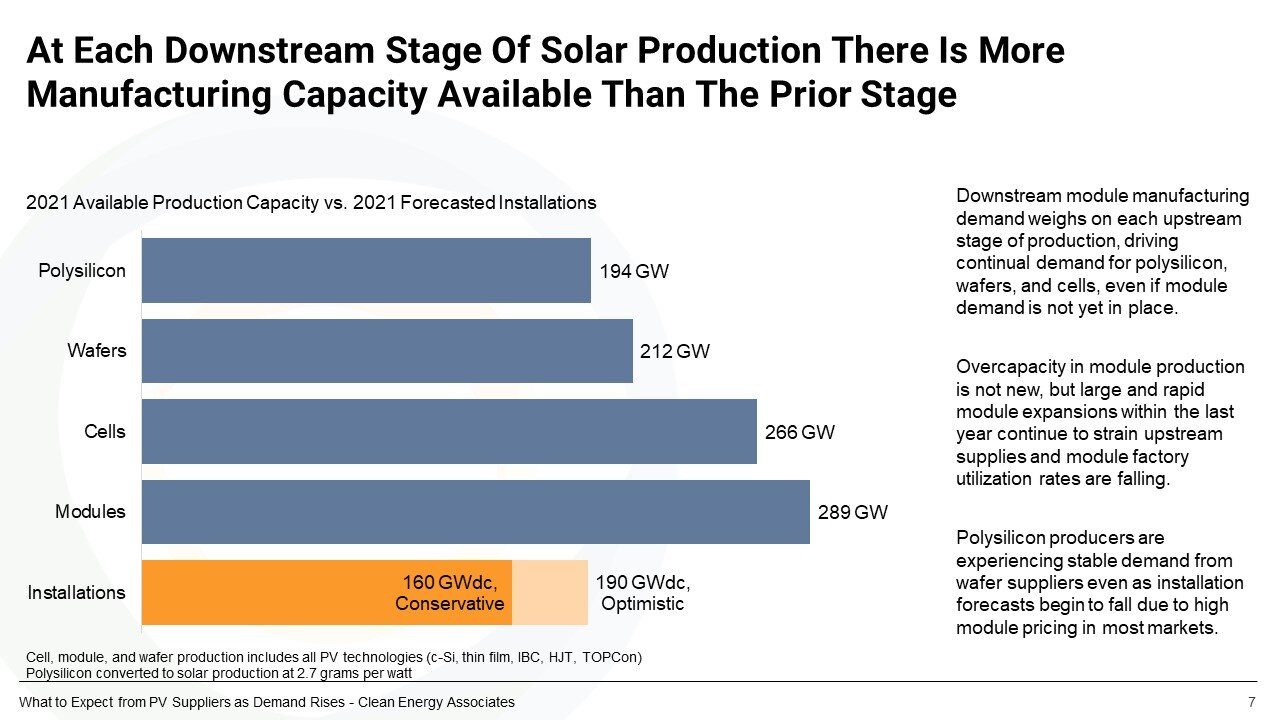

2021 Available Module and PV Raw Material Capacity vs Forecasted Installations

Stages of the Solar Value Chain

First, we want to highlight where different stages of production are throughout the entire value chain and especially how these different production stages relate to the end downstream demand measured here by installations. As you can see from the left-hand chart, we have an increasing amount of production capacity as we move downstream from polysilicon, all the way to module production. Then the significant gap between your first upstage raw material refinement in polysilicon production. And then the final manufacturing capacity for modules is creating a significant disconnect between what manufacturers would like to produce and what the industry is actually able to supply in terms of components and equipment, and the sudden expansion on the module side as quickly followed by the cell side is leading to an even tighter mismatch between upstream production stages and the final demand from end users.

Effects of Increasing Polysilicon Demand

And as we're seeing more module makers continue to demand more cells and cell makers continue to demand more wafers and wafer producers, all vying for limited amounts of polysilicon production this year, we're seeing prices increase at every stage of the value chain and additional costs being passed on to consumers. And even as projected installations are starting to now tend towards the conservative side, in that some buyers are anticipating they may hold off on projects in 2021 due to higher pricing, the upstream segments can not always necessarily afford to pass on the full amount of cost increases to buyers. They are reducing margins, but they continue to produce large amounts of product just to keep factories running and to keep their utilization rates at above a bare bones level.

And so we'll go throughout each one of these stages in a little bit more detail and figure out where bottlenecks are developing and when bottlenecks are expected to start alleviating.

First, we want to focus on polysilicon.

Polysilicon Supply Vulnerability

Polysilicon became a major topic of concern towards mid to late last year when a series of accidents and major polysilicon production facilities highlighted the vulnerability of this upstream stage of production. Polysilicon supplies had been becoming more constrained over time. As prices had been falling, low cost, Chinese production started crowding out other sources of European American and other non China, Asia production, forcing those producers out of the market and really condensing polysilicon producers to a few major suppliers.

The narrowing of that polysilicon production chain really hit the forefront of news when all of a sudden a huge shock to demand born out of those accidents at some other polysilicon facilities really focus attention on how tight the supply and demand had become for polysilicon.

And even though the result of these accidents was that polysilicon producers realized some expansion would be needed in order to sustain downstream production and suppliers all throughout the solar production supply chain realized they needed to be more cognizant of this upstream sector. The reality is polysilicon is a very timely - new polysilicon production is a very timely process, time intensive process. And even though construction on new facilities has begun, it's not really expected to come online in any sort of meaningful capacity until very late into 2021. But more likely into 2022 after next year's Chinese New Year.

About the Presenter

Joseph C. Johnson is a Manager of Market Intelligence for Clean Energy Associates (CEA). At CEA, he studies PV market trends, technology, upstream supply chains, and supplier quality as part of CEA's Technology and Quality and Market Intelligence departments.