Newly Released Survey of PV Market Leaders Estimates 180 GW of Module Capacity Will Be Online By the End of Year

CEA’s solar supplier market intelligence report showcases large wafer adoption and other emerging technologies as the solar industry rebounds

Denver, Colorado— Clean Energy Associates, a leading solar and storage supply technical advisory, released its second-quarter PV Supplier Market Intelligence Program Report for 2020. The report, available by subscription, is authored by CEA’s Technology and Quality team and includes insights gathered from 1-on-1 interviews with the technical leaders at many of the industry’s leading suppliers.

The latest report tracks new developments in large wafer adoption by PV module manufacturing leaders and recaps supplier financial health relative to the pandemic. While production has returned to normal for Chinese and most Southeast Asian manufacturers, COVID-19 is still affecting solar demand in international markets.

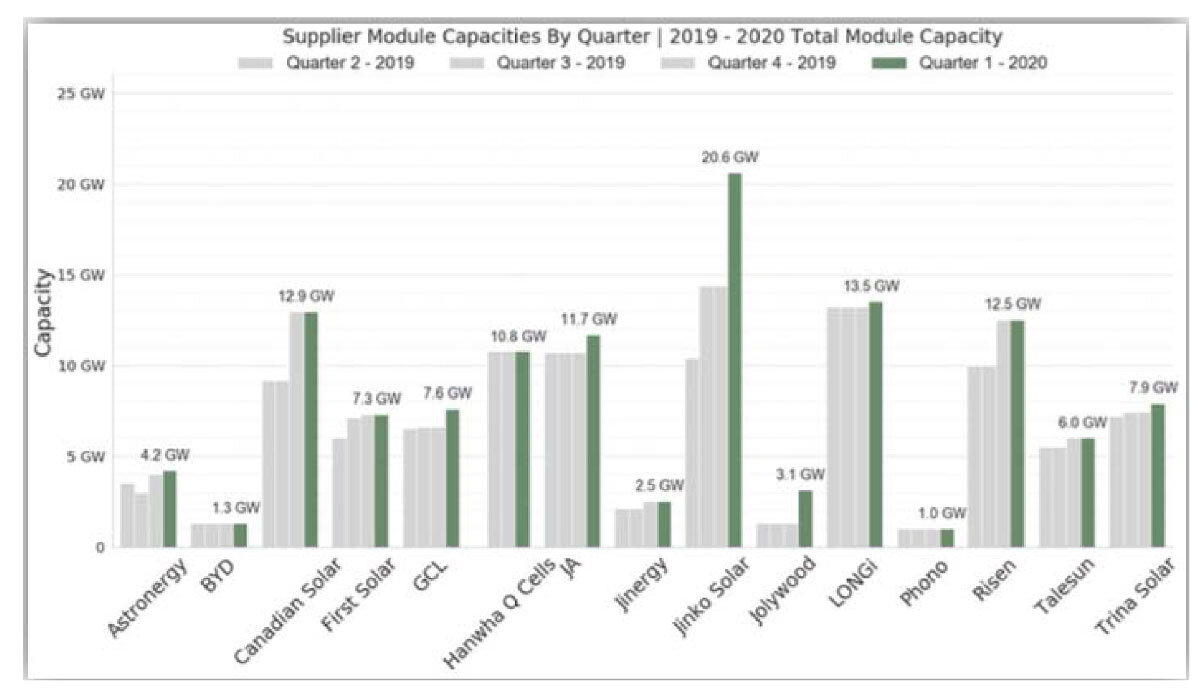

Despite a first quarter that was quiet in terms of cell capacity expansions, CEA estimates nearly 180 GW of module capacity will be online by the end of this year in China alone, accompanying almost 185 GW of cell capacity thanks to a combined 66 GW of new cell expansions announced by Aiko and Tongwei. Among suppliers continuing multi-GW expansions are Jinko Solar and LONGi, with Risen and Trina Solar also moving ahead.

Companies analyzed in the report include: Astronergy, BYD, Canadian Solar, First Solar, GCL, Hanwha Q CELLS, JA Solar, Jinergy, Jinko Solar, Jolywood, LONGi, Risen, Talesun, Phono Solar, Trina Solar

PV Module Manufacturers Adopt Large Wafer Sizes

The supplier market intelligence report finds that virtually all suppliers are adopting larger cells and wafers though not everyone is pursuing the same wafer size. Some are joining the M6 (166 mm) wafer size club while others are counting on the 210 mm wafer size and others are now planning on something in between – 182 mm. The report highlights both the opportunities and risks associated with increased wafer size. Using bigger wafers to increase the power of the modules reduces the number of modules needed, which can directly save costs on labor to install the modules in construction.

However, just increasing the wafer size or quantity of cells in a module, without optimizing the module’s design and/or using higher efficiency cells, in order to increase the module efficiency, can introduce other unexpected problems that may end up increasing the cost at the end. There may also be additional considerations and costs associated with racking systems and glass size.

Manufacturing Adopting New Shingling, Tiling, and Paving Technologies

In addition, the report considers innovative approaches to pack more power in the same module area by interconnecting cells in smarter ways. This includes shingling, tiling and paving. All suppliers surveyed are currently developing one or all these technologies; a few leading names are already rolling out these products in mass production.

“We still have a long road ahead in the global economic recovery, and the demand for solar power and energy storage has never been stronger,” said Paul Wormser, VP, Technology of Clean Energy Associates. “Our industry continues to be grounded in innovation, and the evolution of wafer size is key to further cost reduction. As large-wafer technology scales, our quality assurance engineers will be in module factories to ensure that training, processes, equipment and materials are all well suited to produce high-quality modules with larger cells.”