An Object in Motion: The US Battery Storage Industry Will Keep Moving

By Dan Finn-Foley

This article was originally published in Energy Storage News

Dan Finn-Foley of Clean Energy Associates looks at the road ahead for the US battery storage industry in the first of a series of regular, exclusive Guest Blogs for Energy-Storage.news.

Container ship at the Port of Los Angeles. Tariffs on Chinese energy storage imports to the US were introduced under the Biden-Harris administration in May 2024.

As the energy industry processes the results and potential impacts of the recent US election, some may call to mind Newton’s first law of motion: an object at rest tends to stay at rest. As new political, policy, and regulatory realities emerge, the trajectory of the cleantech revolution in the United States will be closely watched.

This is not the first time clean energy has found itself at a crossroads during a political shift. President Carter was keenly aware of the laws of inertia when, in response to the energy crisis in 1979, he symbolically installed solar hot water on the White House roof and dramatically scaled up US investment in PV, turning the US into a global leader.

During the Regan administration the solar panels were taken down and, amid falling oil prices, much of the US’s investment into solar power was removed. Absent external forces, just as an object at rest, the solar industry remained stationary for decades.

Now, however, others may keep Newton’s first law of motion in mind which, interpreted slightly differently, states that an object in motion stays in motion. Inertia is now on the side of the energy transition. According to the national Energy Information Administration (EIA), renewable energy accounted for 10% of generation in 2010.

In 2020, it was 20%, and solar deployments doubled from 2016 to 2019 and again from 2020 to 2023. But unlike the first Trump administration, the energy transition was squarely within the spotlight of the recent Trump campaign, and a range of tools, from erosion of the Inflation Reduction Act (IRA) to increased tariffs, to detentions under the Uyghur Forced Labor Prevention Act (UFLPA), are all potentially on the table.

The impacts on the energy transition, and energy storage in particular, could be dramatic, particularly given what some may see as the industry’s reliance on inexpensive China-made lithium iron phosphate (LFP) batteries.

Growing pains for battery storage manufacturing

The first energy-storage-specific tariff, however, came from the Biden administration in May 2024, when it announced 25% scale-ups on tariffs for China-made batteries beginning in 2026.

Combined with advanced manufacturing tax credits and adders to the investment tax credit for domestically made products, this approach aimed to accelerate the US battery manufacturing industry. It worked, and CEA is now tracking more than 80GW of nameplate stationary-storage-focused battery manufacturing proposed to come online through 2028.

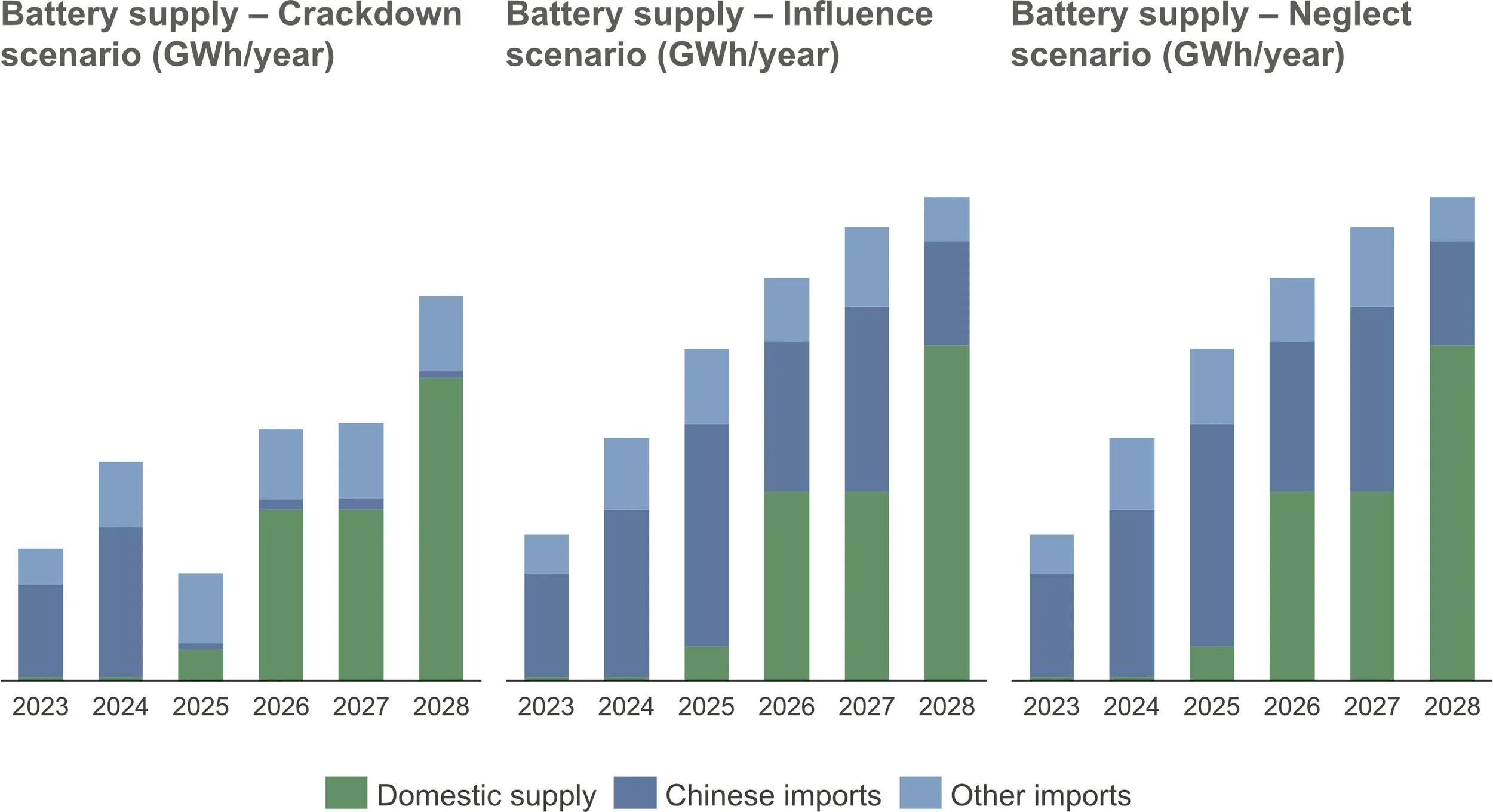

But new manufacturing bases do not come without growing pains, and based on historic trends and direct research, CEA anticipates that maybe only a fraction of this capacity will come online in the stated time frames, leaving a supply gap of 63% next year and of 29% in 2028 which will have to be filled.

This production capacity depends on existing tax credits, which have achieved some Republican support, as evidenced by a letter signed by 18 Republican congresspeople in August 2024, 14 of whom won their reelection bids.

How the remaining supply gap is met will depend on numerous difficult-to-predict factors, particularly surrounding executive action on detainments under UFLPA and promised increased tariffs.

CEA’s outlook on ULFPA: Three scenarios

CEA has developed three potential scenarios for a Trump administration UFLPA strategy:

Under the first, UFLPA may be used to restrict China-made battery imports, supply plummets in 2025 as detentions surge, and imports from other countries (primarily South Korea) cannot make up the gap. The timeline is too short for US manufacturing to scale up quickly to meet the increased gap, and demand destruction is possible.

One of the benefits of inertia, however, is scale, and with scale comes influence. Battery imports are sufficiently large to have many influential stakeholders across the country, and it is anticipated that trade groups will make a strong case for exceptions, or the administration may simply be encouraged to focus on other policy priorities, leaving the market at essentially a status quo.

These two outcomes represent CEA’s second two scenarios, where, given the growing influence of the battery industry, and its investments and employment in red states throughout the country, detentions and delays will likely occur, and budding domestic battery production plays an increasingly significant role.

Should imports continue under this scenario they will have to contend with a spike on tariffs, which the Trump administration can implement quickly and without congressional approval.

In May 2024 President Biden announced a 25% increase on China-made batteries would begin in 2026 through section 301. Trump campaigned heavily on tariffs, meaning this baseline number could be extended to potentially 60% or 100% in CEA’s potential scenario analysis.

Notably, under a 60% to 100% high-tariff scenario, US-manufactured DC blocks would be cheaper than imported China-made DC blocks, even given recently plummeting prices coming out of China. This, plus tax credits, would allow domestically produced cells to dramatically out-compete imported battery storage systems. This does not, however, account for potential escalation.

The US battery industry is still highly dependent on lithium chemical imports from China; an increase in tariffs on these could offset credits under the Inflation Reduction Act and reduce US competitiveness.

When Jimmy Carter installed solar hot water on the White House he stated: “A generation from now, this solar heater can either be a curiosity, a museum piece, an example of a road not taken or it can be just a small part of one of the greatest and most exciting adventures ever undertaken by the American people”.

His words were prophetic. A generation later one of the panels is on display at the Solar Science and Technology Museum in Dezhou, China, another at the Jimmy Carter Presidential Center, and a third at the National Museum of American History, and solar itself is being deployed at a scale that was unthinkable four decades ago.

The energy transition took decades to accelerate but, now that it has, the scale of it as an undertaking has transformed from a vulnerability to a strength.

CEA’s potential scenarios for energy storage indicate that the US manufacturing renaissance is likely to continue, deployments will surge, and tariffs will struggle to slow the market down in the long-term. The “most exciting adventure ever undertaken by the American people” will probably continue, and as with any good adventure, the best is still to come.

Dan Finn-Foley is director of Energy Storage Market Intelligence at Clean Energy Associates (CEA). Dan is an energy transition and storage specialist with over 15 years of experience in the field. His work centres around business strategy, industry trends, the intersection of policy and economics, and emerging technologies.